Creating success, and it’s byproduct, wealth, is never easy. However, it is made easier in certain countries.

Some countries take significantly less in taxes than others, which provides more of an incentive for individuals and businesses to pursue success.

The less tax you must pay to your country, the more of your success you’ll be allowed to keep.

No matter how successful you may be, however, if your country’s tax system punishes success with excessive tax rates, building wealth will be very difficult.

THE GOOD

In the UAE, you will pay zero in taxes on the income you produce from your business or earn as an employee. So, in the UAE, success is heavily rewarded.

Kuwait is not far behind the UAE. It’s corporate tax rate maxes out at 15%. Even better, if you are an employee, you pay zero in income tax.

Ireland is pro-success as well, at least for businesses. The corporate tax rate is only 12.5%. However, if you are a successful employee, Ireland punishes that success with a punitive 52% tax rate.

Switzerland has a higher corporate tax rate than Ireland, at 18%. But that rate is still very low compared to other countries. And, unlike Ireland, it does not punish successful employees. It’s top personal income tax rate is only 11.5%.

The U.S. has moved into the Good side of the ledger thanks to the tax changes made in 2018. Top corporate taxes have dropped dramatically from 35% to a flat 21%. And for those non-corporate businesses out there, the 20% Qualified Business Income deduction is a significant tax benefit, encouraging entrepreneurship. Unfortunately, the U.S. personal income tax rate, as high as 37%, punishes successful employees.

THE BAD

You don’t want to pursue success as a business in India. It’s corporate tax rate can be as high as 35%. Plus, if you’re a successful employee, you can pay as much as 30% to the tax collector.

Japan hits you up with a corporate tax rate of 30% and, like Ireland, punishes employees who become a success, with a tax rate as high as 56%.

Germany makes it hard for businesses to pursue success with a corporate tax rate of 30%. They make it even harder for individuals, with a tax rate that can be as high as 47.5%.

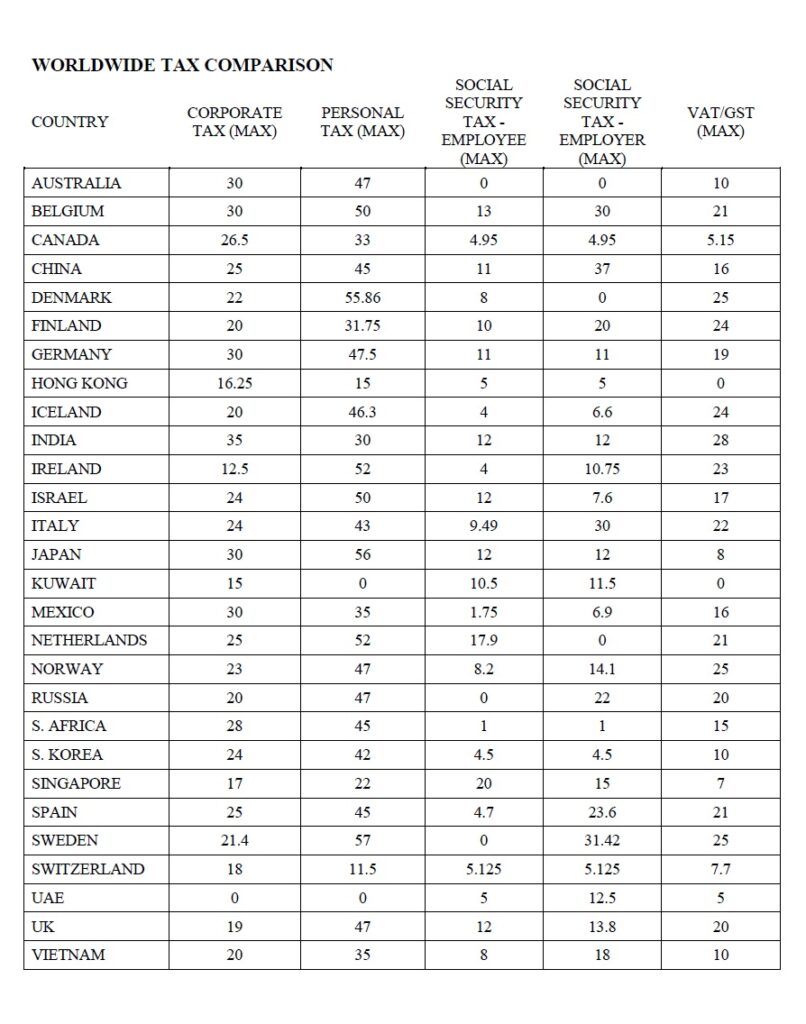

In the attached PDF is a comparison of worldwide taxes for most of the industrialized countries around the world. Which countries do you think incentivize, and thus encourage, the pursuit of success. And which ones discourage it?

For more information, check out my Worldwide Tax Comparison:

My mission is to share my unique Rich Habits research in order to add value to your life and help you realize increased wealth, superior health, abundant success, fulfillment & happiness. If you find value in these articles, please share them with your inner circle and encourage them to Sign Up for my Rich Habits Daily Tips/Articles. No one succeeds on their own. Thank You!

Hi Tom

here is another tax that Australia is about to add if it passes through parliament, unrealised capital gains tax inside Superannuation!

tax on gains of assets without selling them,thats a wealth buster right there!

, they are going to tax people on increases in assets without actually realising the gains.